Earlier this month we asked the simple question of our customers and contacts involved in exporting what they considered to be their top challenges in 2023 – the answers were illuminating…

Brexit

No-one expected Brexit to be a smooth process, but neither did we expect that suddenly we would be hit with a barrage of red tape and eye-watering punitive import tariffs. A good number of respondents said that they had to stop supplying direct to consumers in Europe as the combination of import taxes and the customs red tape meant that they were making a loss. One story in particular struck a chord – “My friend owns a very successful music shop. He was exporting lots of guitars to Europe until Brexit and then his customers reported very high importation charges which killed his export business overnight. It now costs around £3-400 in duties to buy a £1400 guitar from Europe.” Another respondent who sells electronics online said that now he dreads seeing an order from Europe as he knows there’s a good chance that he’ll lose money if he fulfils it. He has now sought out a distribution partner based in Europe to service the European market but has had to give away 20% of his profits as a result. The problems aren’t limited to B2C business – B2B is equally impacted. We have heard many reports of difficult customs officials making requests from customers to complete endless new forms and pay import taxes upfront making it especially awkward to do business with a new customer. Different customs offices within the EU are requesting different clauses in documentation causing confusion and delays. One respondent specifically mentioned problems with sending product samples. “Product samples are almost always causing problems and they are being held in customs for a long time (just recently I sent a sample and it was held for 64 days). Equally product returns, and spare parts are being held up and sometimes disappearing altogether leaving customers frustrated.

Environmental regulations are also becoming a challenge as some requirements in Europe differ to those in the UK, this includes packaging and pallets.

Ukraine

Not surprisingly many mentioned the knock-on effects of the war in Ukraine, everything from the immediate loss of sales to Russia – including cancellation of significant long terms contracts – to the increased fuel costs involved in shipping. One commented that “freight costs seem to have tripled since the pandemic” and in large part this seems to be fuel related. There may be some light at the end of this tunnel with one respondent commenting “ex-UK [freight carrier] rates are not as high as they were roughly 6 months ago but are still digging fairly far into our margins.”

Inflation

Inflation was a common theme with the unpredictability of raw material costs making it harder to quote for supplies that might not be delivered for a few weeks or months. There have also been quite significant spikes in the value of the pound v/s the Dollar and Euro which some businesses have found fell just at the wrong time and cost them significantly on their profit margins.

Covid

Covid has of course impacted on business globally, and in a number of different ways. For a start we couldn’t travel and get face to face with our customers, and Zoom calls just don’t allow the same level of interaction. One respondent noted how they had lost so many of the personal links with their customer base as so many people had moved jobs during the pandemic. We all know how long it can take to build up trust with a customer in an export market, where linguistic or cultural differences can exist. Having to start again with a brand new contact when travel was still restricted was tough and led to some losing business they had enjoyed for years. Now we are able to travel again – it’s more important than ever to get some physical meetings with valued overseas clients.

What can be done to overcome these challenges?

A great many businesses involved in direct supply to consumers are seeking distribution solutions based within Europe, and there are some low-cost solutions available – especially in Eastern Europe where wage and transport costs are lower. Although the up-front cost of establishing your own operation may be too much for some, there are some collective warehouse and distribution providers who operate virtual offices alongside warehouses where products from a number of businesses are picked and packed. Of course this is potentially moving jobs out of the traditional UK based distribution centre, but if the only other option is to become uncompetitive then there is a simple choice.

None of us are in a position to influence the war in Ukraine sadly, but there is hope that with the end of hostilities the Russian market may open up once more at least in certain sectors. Fuel costs relating to freight are softening slightly from their peak in mid late 2022.

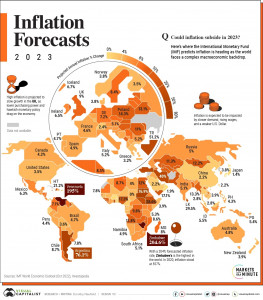

The inflationary effects of increased raw material costs, higher wages and freight costs are still impacting global business, and many are having to ride out the worst effects in fear of losing business altogether if they put prices up to their customers. That said, the January 2023 World Economic Outlook Update projects that global inflation is expected to fall to 6.6 percent in 2023 and 4.3 percent in 2024. This is still above pre-pandemic levels, but not as severe as the 10% + figures we saw in 2022.

The Graphic below published by visualcapitalist.com shows the variation in the projected rates of inflation in 2023 by country, allowing the forward-thinking exporter to pick their target markets carefully.

Finally, it’s worth saying that despite these challenges there is hope. The outlook for global growth is also more favourable than predicted with positive changes such as China’s recent reopening paving the way for a faster-than-expected recovery. Although growth is projected to fall to 2.9 percent in 2023 it is expected to rise to 3.1 percent in 2024 compared to an historical average of 3.8 percent. Of course some areas will see greater growth than others, so the best chance of beating the trend is to target areas of the globe where growth is ahead of the curve. Across Europe, the average projected GDP growth rate is just 0.7% for 2023 according to recent IMF figures. Both Germany and Italy are forecast to see slight growth, at 0.1% and 0.6%, respectively. Growth forecasts were revised upwards since the IMF’s October release. By contrast China is expected to see 5.2%, higher than many large economies. While China’s real estate sector is still shaky, the recent opening on January 8th, following 1,016 days of zero-Covid policy, has already boosted demand and economic activity. The Graphic below published by visualcapitalist.com shows projected growth by country in 2023.